Bitcoin (BTC) prices continue to hover around $108,000 following a minor 0.33% gain in the last 24 hours. The flagship cryptocurrency continues to hold steady within a broader consolidation range between $100,000 and $110,000, reflecting a period of indecision in the market. Amidst the current market status, popular trading expert with X username Daan Crypto has highlighted key liquidity clusters that could play a significant role in shaping Bitcoin’s short-term price action.

The Imminent Bitcoin Battle Fronts: $107,000 And $110,500

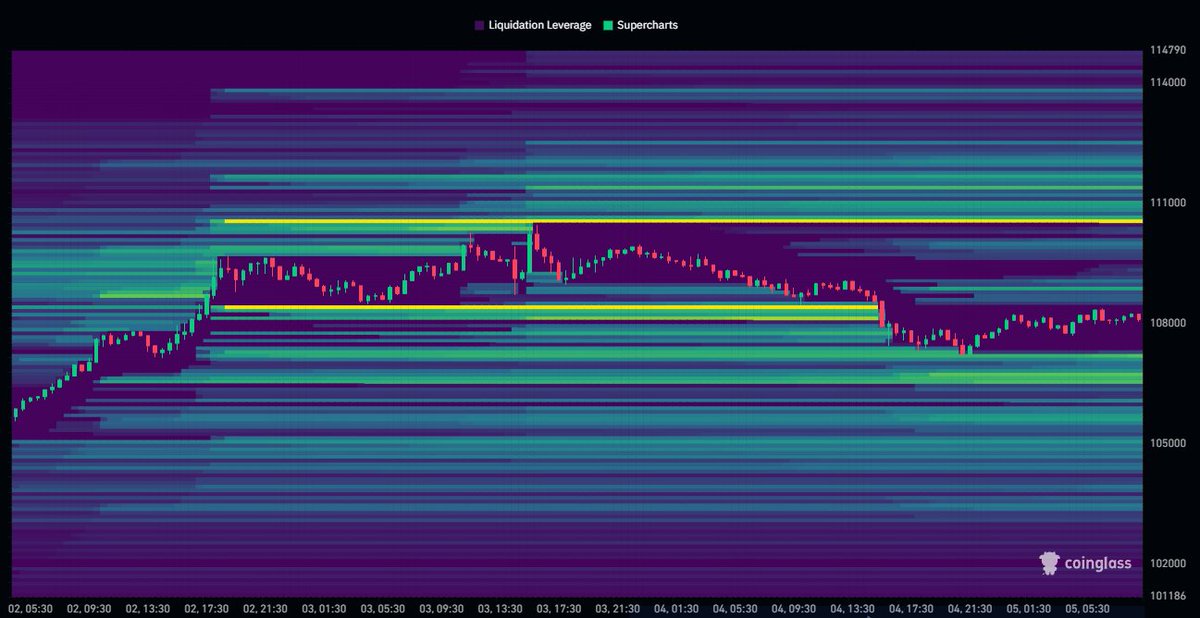

In an X post on July 5, Daan Crypto shares a critical insight on Bitcoin’s potential price action relative to liquidity levels. With data from Coinglass, the renowned analyst explains that Friday’s price activity led to a large-scale liquidation of leveraged positions centered around the $108,000 region. Following this development, investors’ interest is now focused toward new liquidity zones, forming around $107,000 and $110,500.

Of the highlighted regions, the $107,000 region appears to be serving as the immediate support, with some traders defending positions that survived the recent liquidation. Therefore, BTC is likely to experience a short-term rebound upon retesting this level. However, a price dip below $107,000 would trigger large scale liquidations forcing prices to regions as low as $100,000 in line with recent range-bound movement.

Meanwhile, $110,500 is emerging as a near-term resistance where potential sell pressure or short entries could stack up, especially if Bitcoin attempts another breakout. A successful price close above this level would eliminate multiple short positions inducing a short squeeze that could result in Bitcoin swiftly moving past its current all-time high of $111,970 into uncharted price territory.

Overall, the BTC market appears to be stabilizing within the $107,000–$110.5,000 zone following Friday’s sharp liquidation sweep. This sideways price movement typically sets the stage for a swift breakout or breakdown.

Bitcoin Exchange Leverage Reaches New High

In other developments, CryptoQuant data reveals that Bitcoin traders are showing high market appetite as the estimated leverage ratio across all exchanges has reached a new yearly high of 0.27. This metric which tracks the amount of open interest relative to exchange BTC reserves shows an elevated risk behavior as traders are increasingly deploying borrowed capital in anticipation of larger price movements.

Meanwhile, the premier cryptocurrency continues to trade around $108,232 reflecting market gains of 0.70% and 6.41% on the weekly and monthly chart, respectively. With a market cap of $2.15 trillion, Bitcoin retains a market dominance of 64.6% as the largest virtual asset in the world.

Featured image from Pexels, chart from Tradingview

Editorial Process for bitcoinist is centered on delivering thoroughly researched, accurate, and unbiased content. We uphold strict sourcing standards, and each page undergoes diligent review by our team of top technology experts and seasoned editors. This process ensures the integrity, relevance, and value of our content for our readers.

The post Bitcoin Liquidity Map Identifies $107,000 And $110,500 As Critical Short-Term Targets appeared first on Coin24h.com.