TRON is quietly approaching one of its most critical technical levels in years. While the broader market trades sideways, TRX ($0.27) is hovering just beneath a breakout zone that’s been building pressure for a long time. With price action tightening and interest beginning to rise, TRON could be heading toward a breakout moment that’s been seven years in the making.

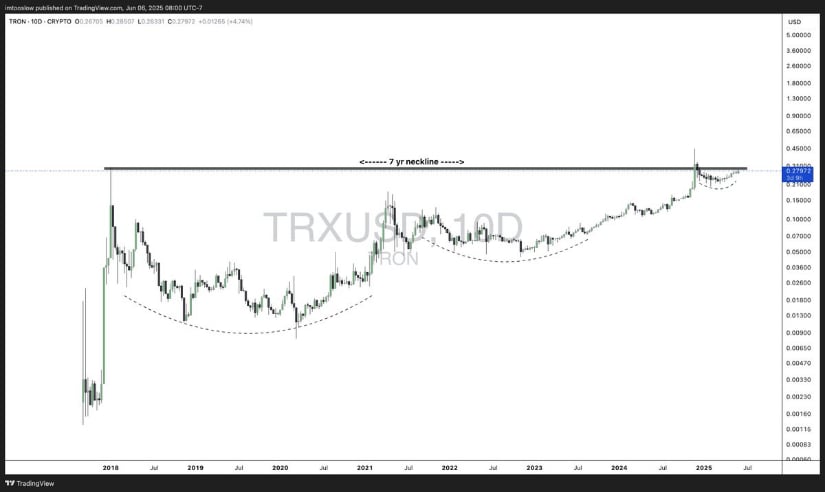

TRON Trades Beneath a 7-Year Breakout Neckline

TRX TRON price is pressing up against a historic technical level that’s been quietly forming for over seven years. The chart shows a textbook Volatility Contraction Pattern (VCP) taking shape just below the neckline that dates back to 2018. Every dip has grown shallower, every bounce tighter, and now the price is hovering right at the breakout zone. It’s rare to see this kind of long-term compression on a major altcoin, and it sets the stage for a possible structural shift in trend.

TRON forms a 7-year Volatility Contraction Pattern. Source: Disrupt Yourself via X

Analyst Disrupt Yourself believes that if TRX can break through this multi-year resistance with strength, it would be a multi-month breakout. The neckline around the $0.28 region is loaded with historical context, and reclaiming it could open up a fresh leg higher towards $0.45 and $0.65 next.

TRXDXY Pair Nearing a Major Breakout

TRON is now flashing another deep structural signal, this time through TRX/DXY pair. Silverbark3 reveals a prolonged downtrend stretching all the way back, with the pair trading tighter inside a narrowing wedge.

TRX/DXY pair trades inside a long-term wedge as RSI shows bullish divergence, hinting at a possible macro breakout. Source: Silverbark3 via X

Price has tested this long-term descending resistance repeatedly, and the latest touch comes as TRON simultaneously presses against that critical horizontal neckline on its USD pair.

Additionally, relative Strength Index is starting to rise from deeply oversold levels, showing bullish divergence forming at the base of the wedge. Holding the support and breakout on this pair would signal TRON gaining strength across the board, marking a shift in TRON’s macro direction.

TRON’s On-chains on Explosive Growth

Following the positive momentum on the technical side, fundamentals are now showing a similar stance. New data reveals that TRON handled a staggering $694.54 billion in USDT ($1.00) transfers in May alone, with $411.2 billion of that coming from whale-sized transactions over $1 million. It confirms TRON’s role as the go-to chain for stablecoin activities.

TRON processed over $694B in USDT transfers in May, dominating stablecoin activity and outpacing ERC-20. Source: Cointelegraph via X

What’s even more telling is TRON’s lead over ERC-20, with $75.7 billion in USDT settled, 17 separate over $1B mints, and over 10.5 billion transactions year-to-date. This shows TRX’s sustained growth. As TRX hovers near a potential breakout zone on the charts, these on-chain flows suggest demand is building.

TRON Technical Analysis

The lower-time frames are showing clear respect for shorter-term momentum structures. A new chart from AltWolf highlights TRX holding above its 200 EMA on the 4-hour chart. The chart reveals a well-defined ascending channel, with price bouncing neatly off the lower boundary and the 200 EMA, marked by several green arrows, indicating demand zones.

TRX holds firm above its 200 EMA in a rising channel, signaling bullish momentum on lower timeframes. Source: AltWolf via X

This upward channel, coupled with clean higher highs and higher lows, suggests strong trend structure. As long as TRX holds above the dynamic support of the 200EMA at $0.270, bulls have control. If the price gets back above the mid-channel horizontal resistance around $0.280, a move toward the top of the channel, which currently aligns with the $0.295 to $0.30 area, remains on the cards.

TRON’s Quiet Strength

While TRON’s charts are heating up and its technical positioning grows stronger, the TRON community is turning its attention to what didn’t happen during the last cycle. In a recent post, Weiss Crypto highlighted this rare resilience, noting that TRON “didn’t even have a bear market last cycle.” That kind of statement isn’t made lightly, especially in crypto, where brutal drawdowns are often seen.

Weiss Crypto notes TRON’s rare resilience, pointing out it “didn’t even have a bear market last cycle.” Source: Weiss Crypto via X

It adds a deeper layer of context to TRX’s current structure, where the token is hovering just beneath a 7-year breakout level while showing strength against the dollar and broader indices.

Final Thoughts

TRON is shaping up a setup that’s hard to ignore. With a textbook multi-year VCP forming just below a historic neckline, TRX seems to be quietly building toward something more sustainable. What makes this moment stand out is the patience TRON has shown. No hype-driven rallies, no flashy headlines, just steady, consistent growth that’s now creating a strong foundation for a potential breakout in TRX price.